Model Portfolios

The Theory A team maintains 5 model portfolios. Each portfolio reflects a unique theme and includes a walkthrough of how they were constructed using the Theory A financial intelligence platform. Portfolios can be followed on the M1 Financial Platform (affiliate link)

75% of each portfolio will be invested in a basket of 20 or so stocks and 25% will be allocated to SHY (iShares 1-3 Year Treasury Bond ETF) as a cash equivalent reserve for re-balancing purposes.

Each portfolios will start with $1000 and continuously add $1000 per month up till $10,000 to simulate a dollar cost average. $50,000 in total will be deployed over 5 portfolios over the course of 2023. This page will be updated and timestamped with each portfolio adjustment.

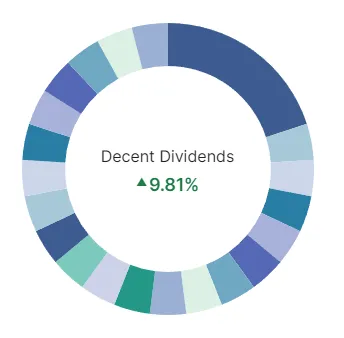

Decent Dividends

The "Decent Dividends" portfolio was released 2/17/2023 and can be viewed here. Dividend investing is very popular but a common misunderstanding of dividends as "free money" can lead to poor investment decisions. This portfolio aims to avoid dividend traps while buying stocks with strong fundamentals, cashflow, and payout ratios.

A complete rundown can be found in our original Substack article.

Link to the M1 Portfolio

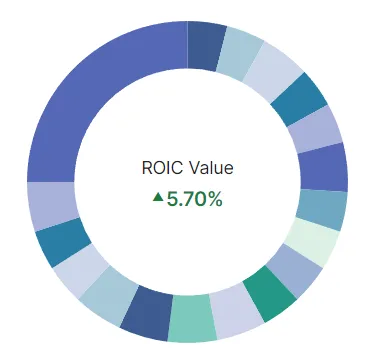

ROIC Value

The ROIC value portfolio was released on 3/5/2023. The full article can be found on Substack. ROIC or Return on Invested Capital is one of the most important signals for a company because it indicates how good a company is at turning money into more money.

Link to the M1 Portfolio

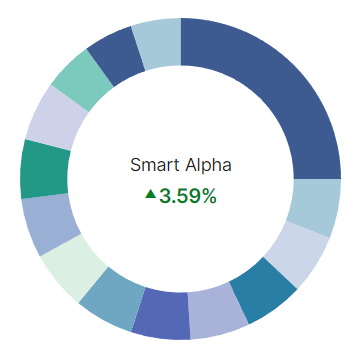

Smart Alpha

The Smart Alpha portfolio revolves around philosophy and outlook of macro analyst Lyn Alden and ROIC.ai founder Vlad Chernikov . It uses Theory A to curate a subset of stocks from their already curated lists. It was released on 3/23/2023 and a detailed description can be found at this link.

Link to the M1 Portfolio

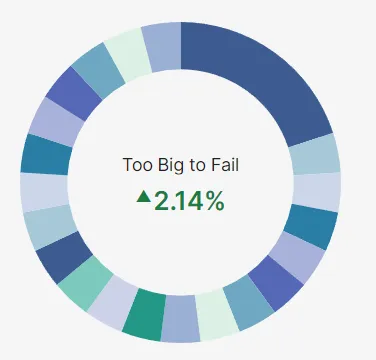

Too Big to Fail

The Too Big to Fail portfolio revolves around picking a select subset of large companies from the SP500. It leverages the momentum of the FIRE movement and the popularity of low cost index funds and is will be used to measure the efficacy of Theory A's value factors relative to market beta.

A detailed breakdown of the portfolio was released on March 19, 2022

Link to the M1 Portfolio

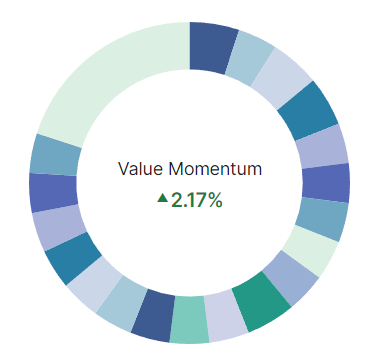

Value Momentum

The value momentum stocks looks for undervalued stocks with decent price momentum. It is heavily inspired by the O'Shaughnessy Trending Value screen described in the book "What Works on Wall Street" by James O'Shaughnessy.

A detailed breakdown of the portfolio was released on March 19, 2022

Link to the M1 Portfolio