Visualize Value Investing

Combine options chain market data and fundamental analysis. Reveal hidden patterns by synthesizing both short term and long term investing strategies.

Hybrid Analysis

Overlay earnings, market cap, and the option chain matrix.

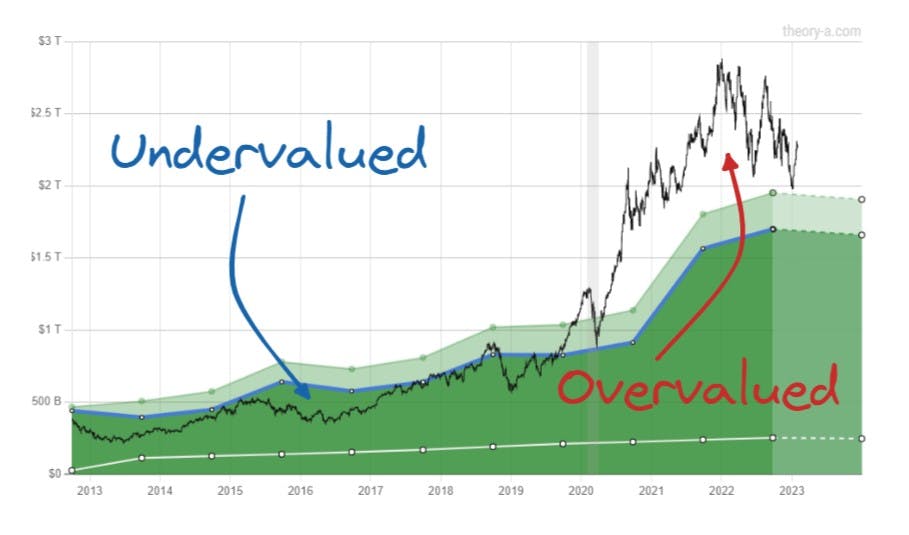

Intuitive P/E Dislocations

Contextualize the Price to Earnings ratio by comparing it against its history.

3D Options Chain

Visualize options data and profit/loss charts in an intuitive 3D format.

Decile Breakdown

Contextualize values relative to all other values.