The Dividend Fallacy

When first introduced to dividends, new investors tend to hold a naive believe that dividends are “free money”.

However as this video reveals, dividends are always priced into the stock. Whenever a dividend is distributed, the price is reduced to reflect the same amount.

A stock that pays dividends essentially take a portion of its value and transmutes it into cash. Like an automated portfolio rebalancing.

This Reddit thread dives into more discussion but in short, there are good reasons to actively look for and hold dividend stocks, but the desire for “free money” is naive.

Here are two better ways of understanding dividends:

Dividends as a Commitment to Shareholders

When a company makes a profit, it has to make a decision on what to do with the cash.

It can be spent on acquiring smaller companies, opening new factories, hiring new employees, and other ways of increasing future cash flow.

But it can also be given back to shareholders directly.

As a shareholder of a company looking to maximize the value of the company, I would prefer that that money be re-invested into the company but only if the return on invested capital increases the value of the company.

A company that returns money to shareholders is essentially saying that they have no good ways of investing money anymore.

This is why growth companies rarely return dividends, it signals that they have no more room to grow.

Shareholders want their money to be invested not wasted.

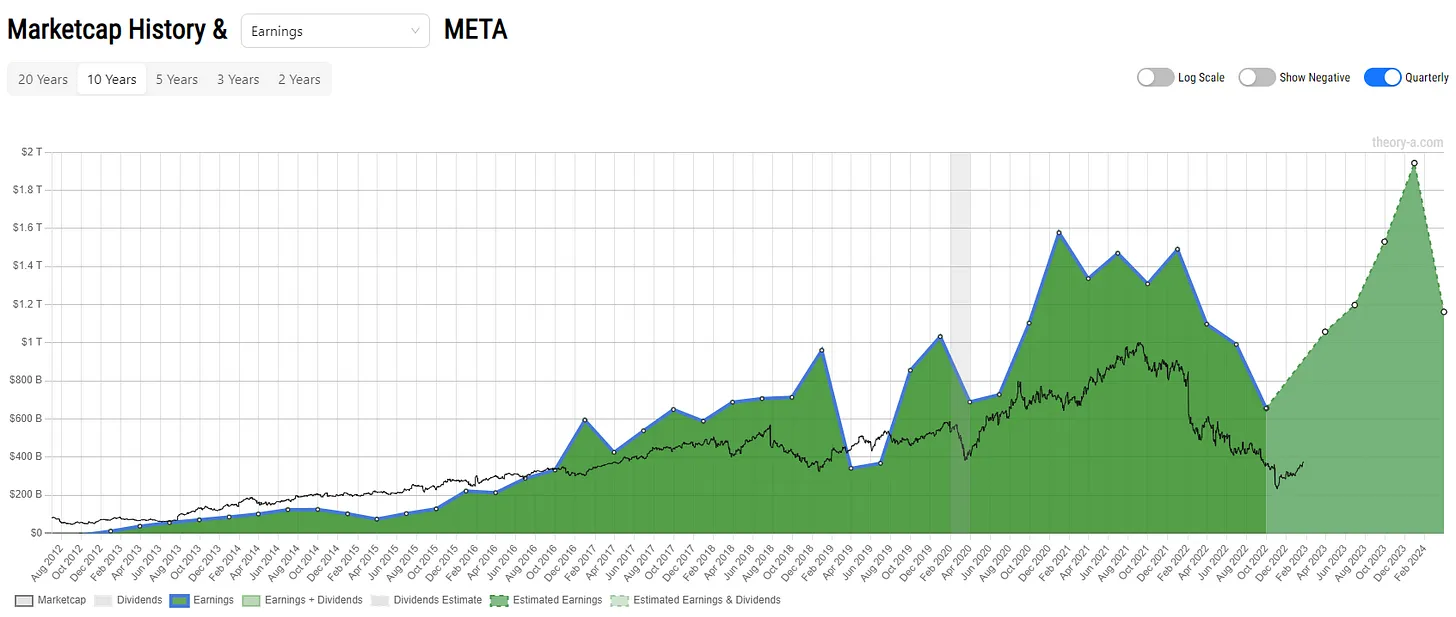

Just look at how META’s stock has been punished. The market consensus is that their exploits into the “Metaverse” are wishful and wasteful. Shareholders would rather they use the company’s strong balance sheet to return value to shareholders, not burn it in an ego trip.

A company that returns dividends, and more importantly, has a track record of increasing that dividend over a long period of time is a company that keeps the shareholder in mind when contemplating what to do with excess cash.

Dividends as a Sign of Financial Health

A company that can maintain a dividend for a long period of time indicates a focus on healthy cash flows rather than aiming for lofty valuations.

Because the value of holding the stock is in its constant cash flow over a long period of time, shareholders and executives who are compensated in equity and incentivized to look out for the long term health of the company.

Contrast this to a SPAC where both executives and shareholders may be looking to pump the price as high as possible and making money by offloading to another buyer before the hype dies down.

There is less responsibility to manage the cash flow of the company because the valuation is built entirely on promises in the future.

The expectation of dividends forces the company to always have one foot in the present rather than spending all their time on wishful thinking.

Downsides to Dividends

Dividends also have downsides. Companies that care too much about returning money to investors often have trouble with innovation because innovation has no guaranteed rate of return.

It’s not clear if the money spent is being burned or will become the Next Big Thing.

Because there is less flexibility with how excess cash is spent, any experimental process or research initiatives is forced to justify itself and jump through many hoops. This additional process can slow down innovation and drive out frustrated talent.

A company that is paying large dividends can become a dividend trap if it loses more market value than it gives out. (which will be taxed when distributed vs holdings that are only taxed when selling)

Payout Ratio: An Alternative Metric

Now that we understand what a dividend is and what it is not, it’s a good time to introduce an alternative: Payout Ratio

Payout Ratio is what percentage of earnings a company pays out to its shareholders.

A Dividend Yield on the other hand is the percentage a shareholder receives relative to its market price.

A company with a high P/E ratio could be returning a large percentage of its profit to shareholders, but the dividend yield can feel low because the market cap is so high.

Because dividend stocks are valued for their willingness to keep the shareholder in mind and as a forcing function to maintain financial health, payout ratio can be a better metric that reflects this commitment.

Payout ratio is always relative to the very real cash flow of the company while dividend yield can fluctuate with the price of the company.

Dividend yield is still more useful if you want to know what percentage of what you’re spending will become returned to you as cash. But understanding the true nature of dividends allows us to avoid the allure of dividend traps and instead focus on what the payout ratio says about the company’s attitude towards shareholders and its management team’s philosophy.

Users of Theory A can use the screener to apply the “Dividend Yield” preset to get started with these metrics. It looks for companies that outperform on putting capital to work (ROIC), Income Quality, as well as Dividend Yield and Payout Ratio.

We will be providing some model portfolios with real money using the M1 Platform in the coming weeks. One will specifically be dedicated towards dividend stocks so stay tuned for that update!

As always, questions and feedback can be sent to me at dj@theory-a.com