Why Market Cap is More Important than Price

Most people would say that Market Cap and Price are the same if not very similar. After all, market cap is defined as the price times the numbers of shares. They technically represent the same information, just scaled up or down.

However, what most people refer to as market cap is actually the Mark to Market valuation. If someone were to actually try to buy an entire company at the current market price, their massive buying activity would influence the sellers.

It makes little sense to multiply the number of shares by the most recent executed sale. It’s useful as a rough estimate, not as a source of truth for what a company is worth.

However, it’s this very trait that allows us to visualize the embodied positive or negative sentiment towards a stock!

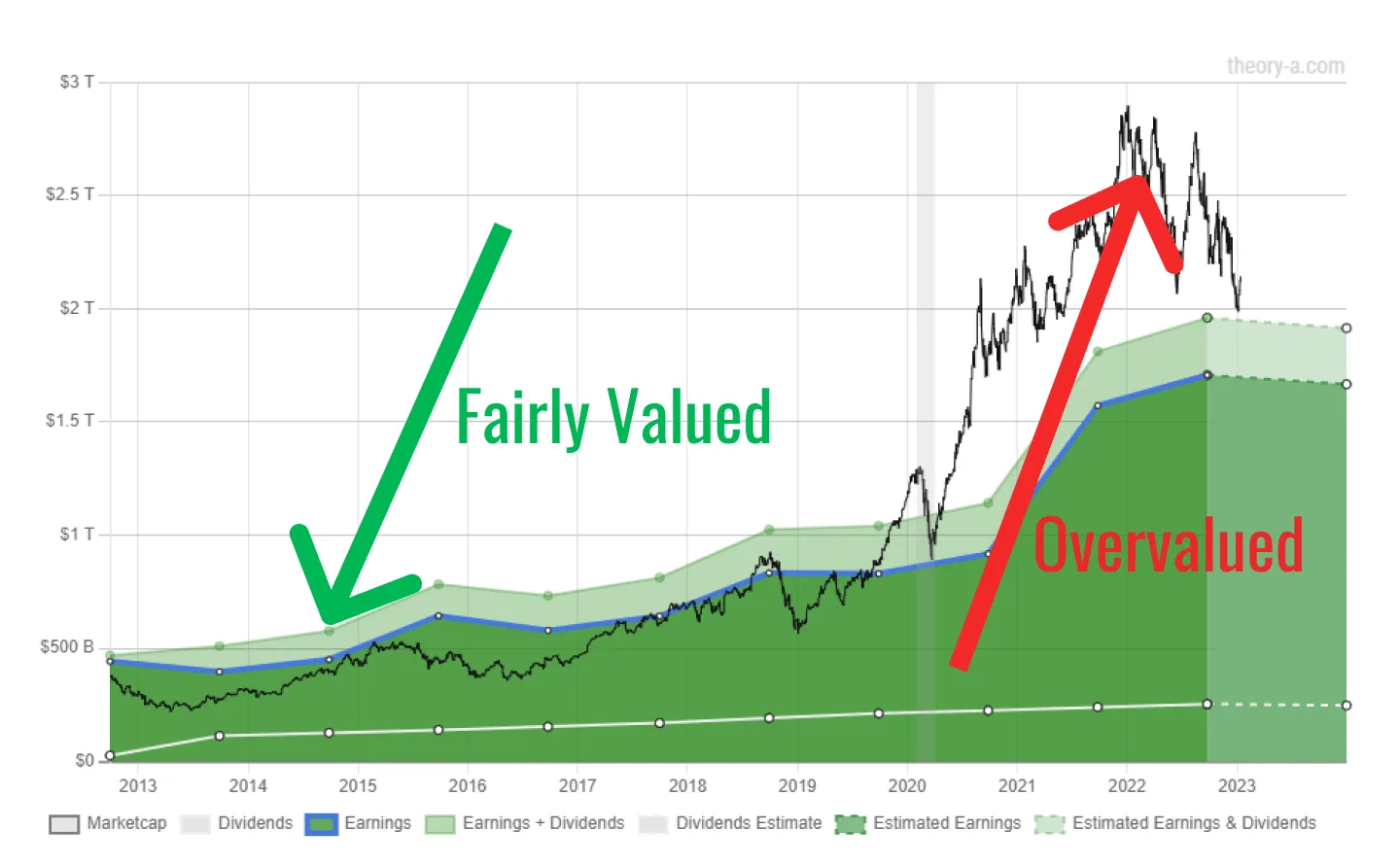

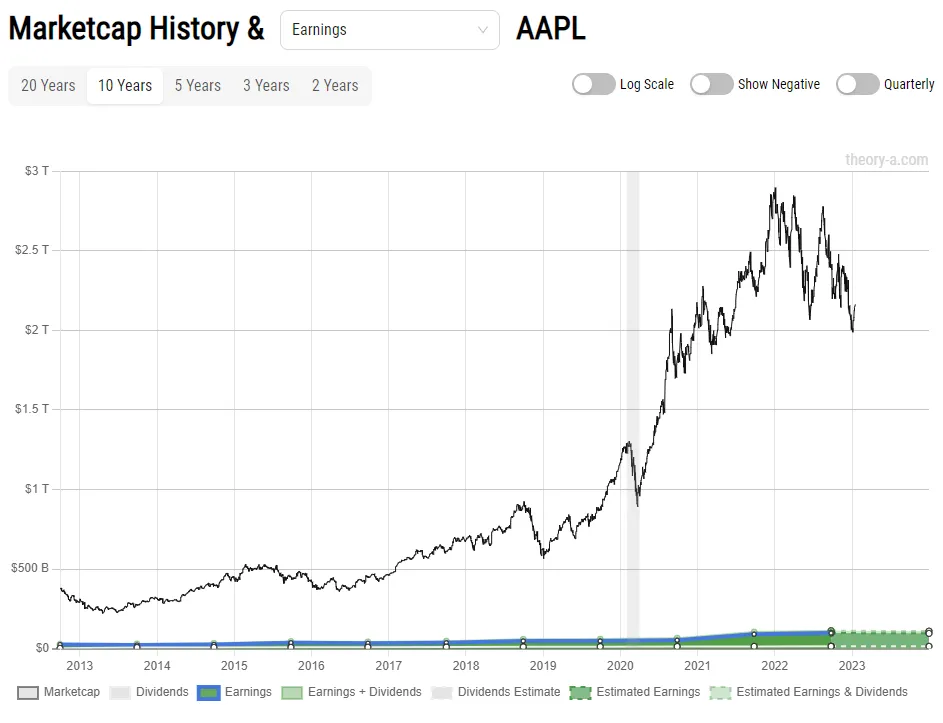

Take this 10 year chart for AAPL. By plotting the market cap instead of the price, we can visualize how the market cap compares with the company’s underlying earnings fundamentals.

This allows us to compare how much money AAPL is actually making relative to how the market is valuing it.

E.g. imagine 1 share of AAPL as a magic box that gave you 5 dollars every year. How much would you be willing to pay for it? Someone who is willing to pay 100 dollars for it basically saying that they are willing to value it at 20x its yearly earnings.

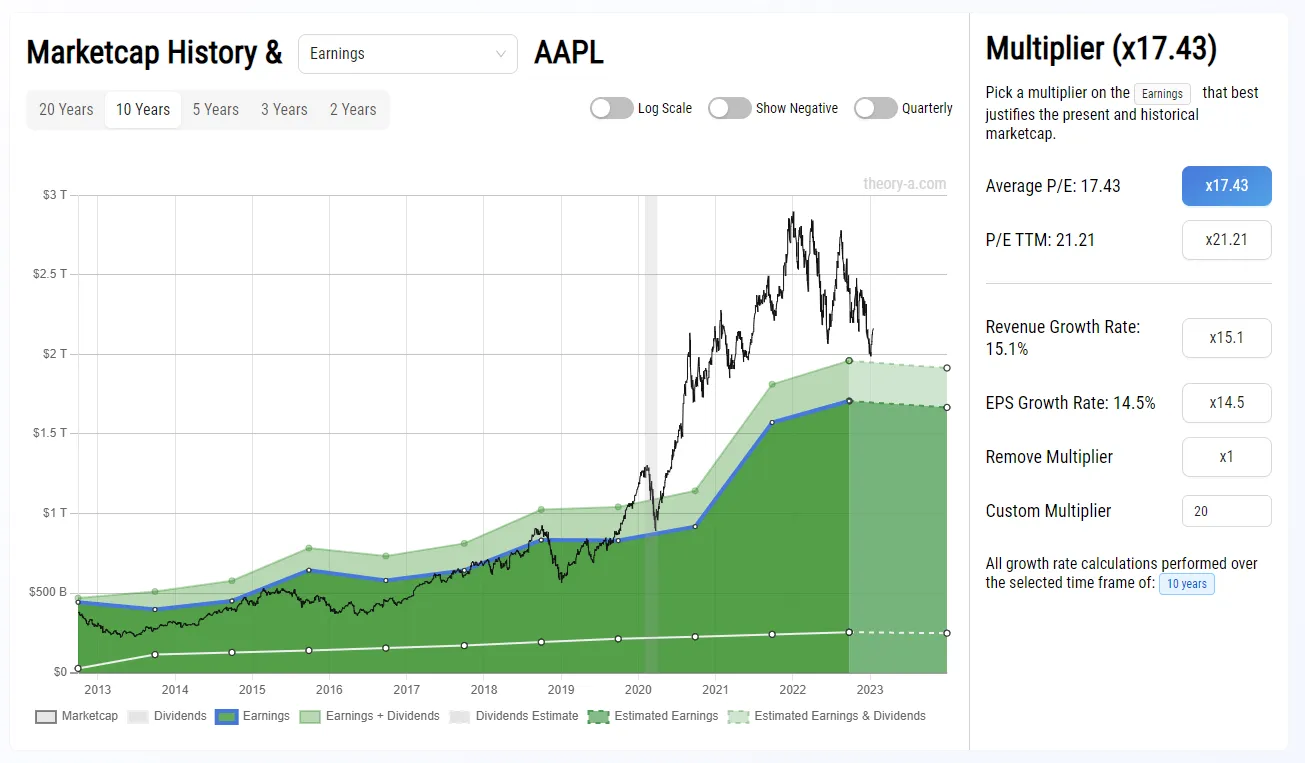

By multiplying the earnings by a P/E ratio (Here we use x17.43, its historical harmonic average) we can then easily visualize how the P/E ratio has fluctuated over time relative to earnings performance.

Here we see that market sentiment towards AAPL rocketed upwards after the 2020 pandemic stimulus and then is slowly returning to historical norms as the Fed hikes interest rates.

So while it may now seem cheap to someone who bought at the all time highs, value investors can use these charts to see that the P/E ratio is still inflated despite the 20% discount. While AAPL is a great company that could surprise shareholders with an unexpected jump in earnings or a novel innovation, the current price is far from a contrarian bargain.

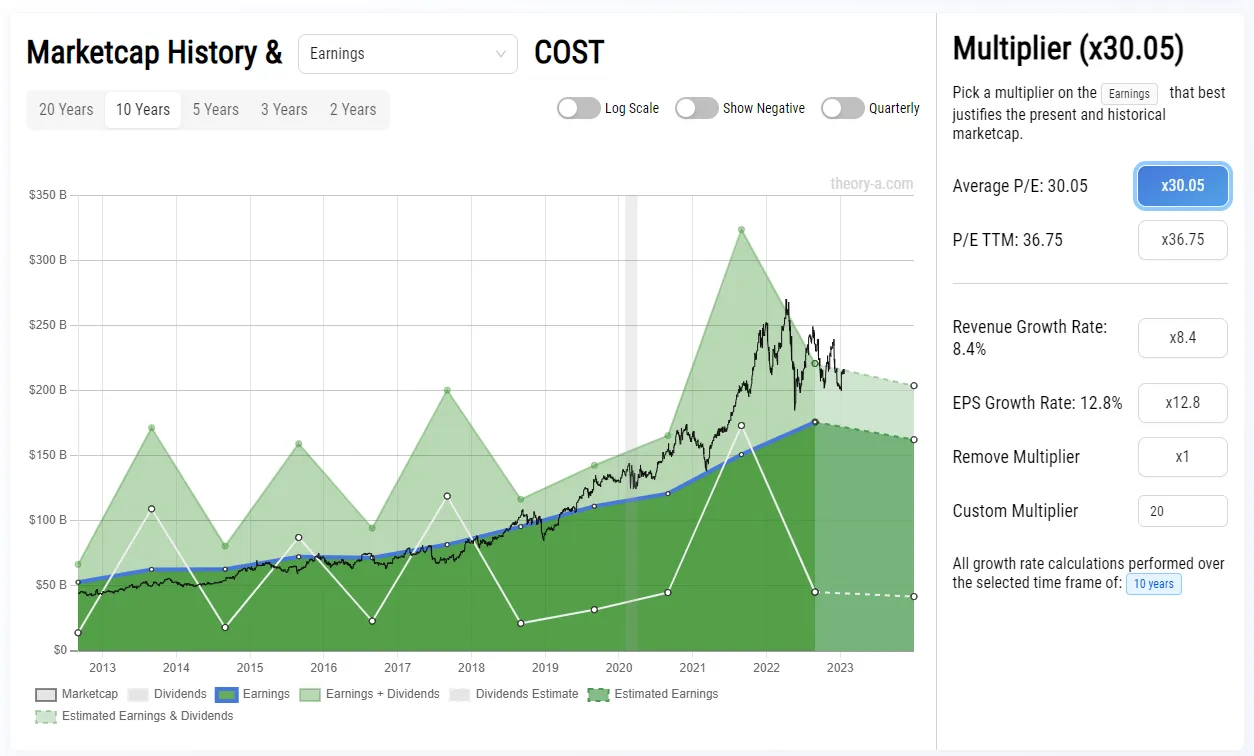

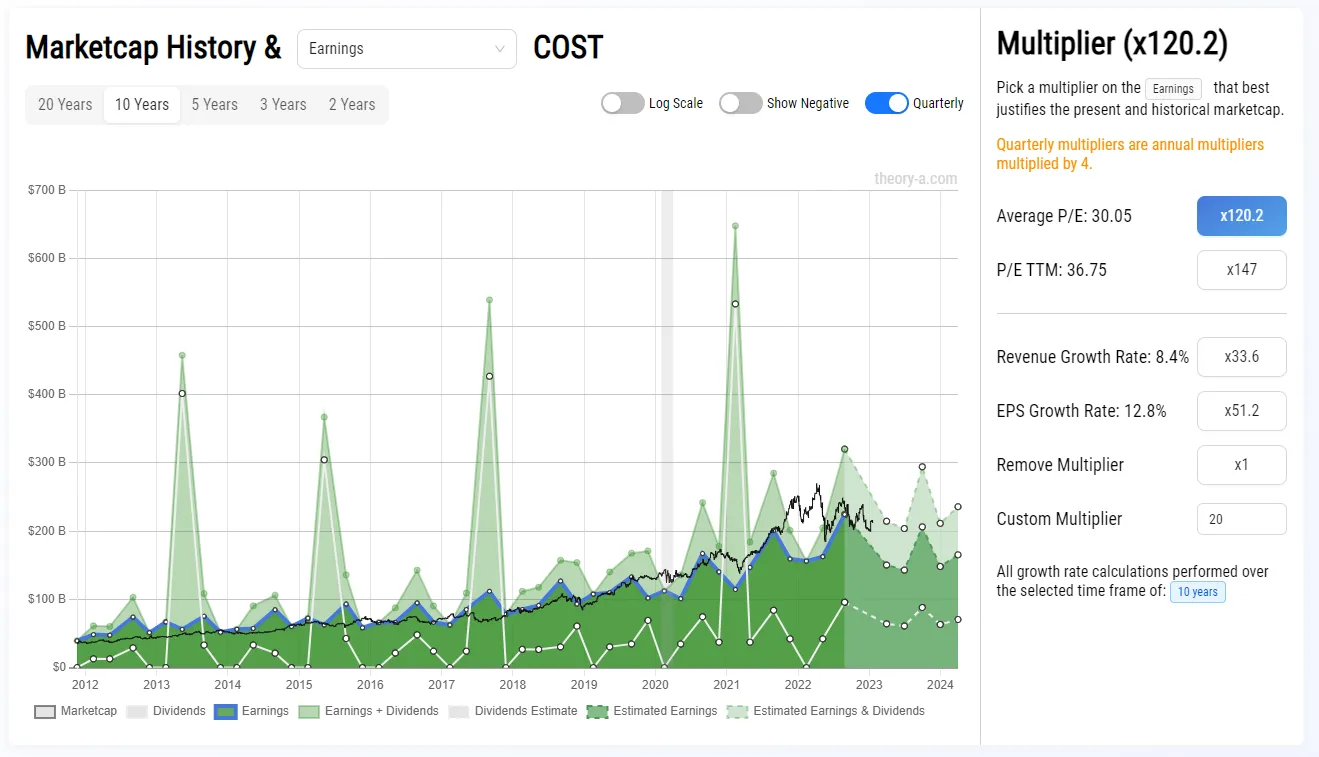

The same goes for COST. A great great company that is still riding its post-pandemic euphoria despite expected growth leveling off, tightening financial conditions, and a slow return to normalcy.

The market consensus is still lagging with regards to the future outlook.

The funny thing about Efficient Market Hypothesis is that the market includes everything into its price including temporary positive and negative sentiment.

By plotting the market cap instead of the price and displaying that information along with a company’s fundamentals, we as investors can see the effect of excessive positive or negative sentiment and judge for ourselves whether or not the valuation make sense.