How Banks Create Money Out of Thin Air

Published: May 17, 2022

In our previous article we discussed the various forms of money in our economic system and how most of what we think of as money is bank debt.

In this article we'll focus on why banks are highly regulated. This regulation is necessary because banks are given the exorbitant privilege of being able to create money out of thin air! Let's explore how this works in detail.

"Normal" Banking

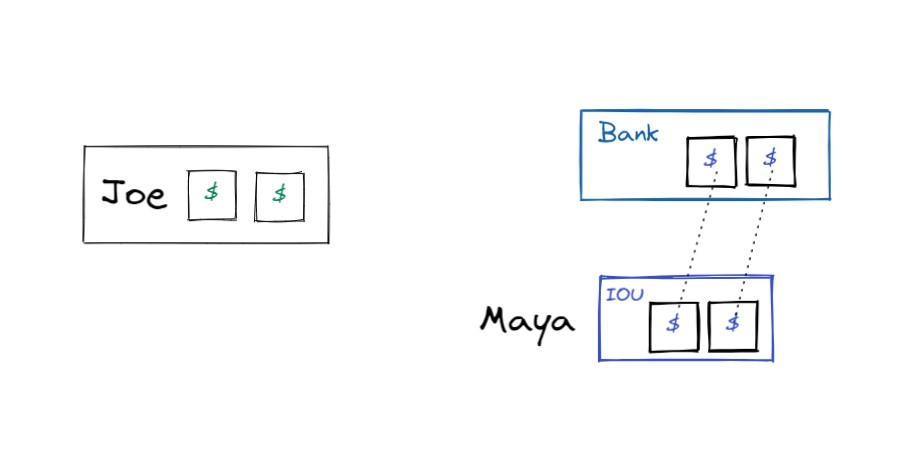

Let's start with an overview of how most people believe banking works. Below we have Joe who keeps a bunch of physical cash. Maya, who doesn't want to deal with cash instead stores her money at the bank. In exchange, she receives access to a bank account and debit card that reflects the amount she has stored with the bank.

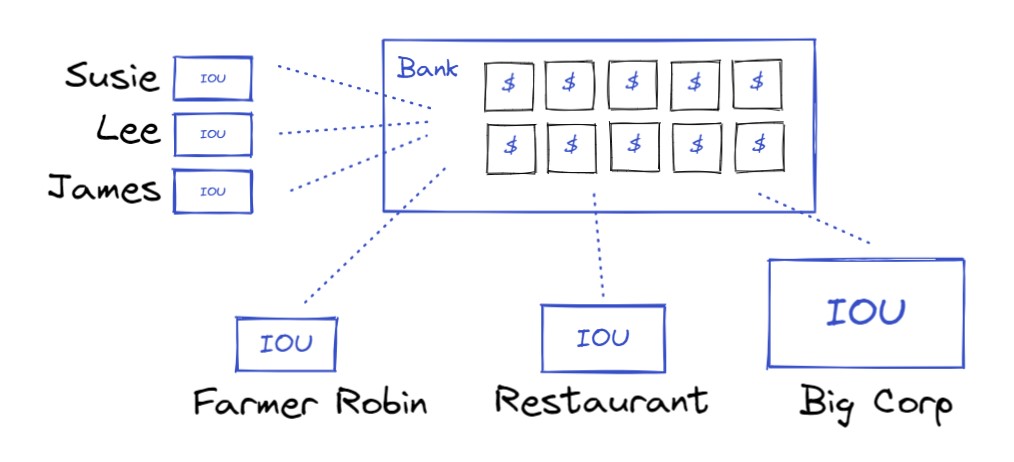

When enough people do this, the bank ends up safeguarding everyone's money.

This is good because digital transactions are easier to deal with. An entire community can pay and get paid digitally without worrying about making change, having it stolen, losing it, etc...

This is great, but it assumes that banks always match the IOUs 1:1 with the cash deposits and that they provide this service for free. In reality, banks need to "turn money into more money".

Time Wizardry

Contrary to popular belief, modern regulated banks do not actually lend out the money that customers keep with them to generate interest payments. While banks do create loans, they simply magic the money into existence with a few computer keystrokes.

However, they are not allowed to do this at will. Their books have to balance. The money that they magic into existence in the present has to be matched with a corresponding future stream of money.

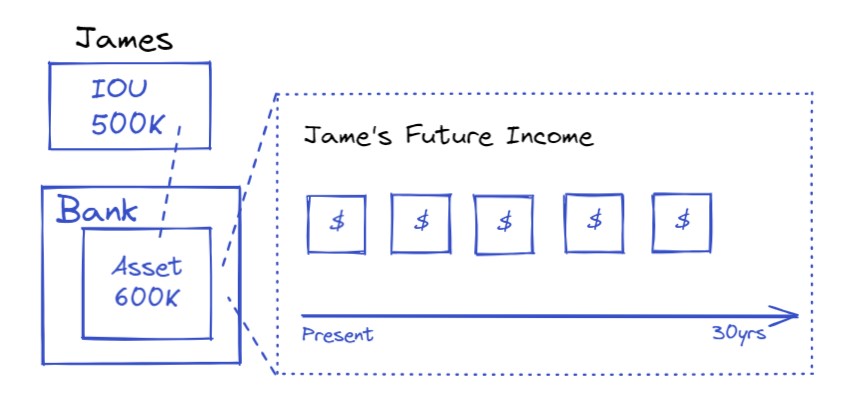

In the United States, the largest source of this magic money is via housing mortgages. If James needs a 500k loan to buy a house, he can go through a loan approval process where he promises 600k of his future income over 30 years.

This loan is an "asset" to the bank because it is a promise of future income. It needs to exceed the value of the 500k of bank liability that the bank magics into existence because it needs to make money on providing the service and also because future money is discounted relative to present day money since it can't be used immediately. (The exact number depends on interest rates as well as the creditworthiness of the borrower.)

Notice how the rest of the customer's funds aren't touched. The only thing that matters is how predictable Jame's future income is.

While banks do provide the service of digitizing cash and reducing the friction of transactions, their main purpose is to bring money from the future into the present.

The 500k in the example above immediately appears in Jame's bank account and is given to the seller. This money is immediately injected into the economy as the sellers can use it to pay the realtors, closing agents, invest a portion, buy a new house, etc...

This supercharges the economy because there is now more money in circulation.

However this money isn't "free". It was created via a promise of 30 years of continued payments. This is why debt can feel like slavery. It constrains and locks down a pattern of activity far into the future.

Most individuals recognize the danger of debt and so only use it to buy things that increase spending power so that the debt can be paid down. E.g. buying a car or tools, learning online courses,

In theory, banks provide this magical service that supercharges the productive capacity of an economy.

In practice this is limited by the bank's ability to predict and managed the future as well as each individual's borrowers ability to make good use of the additional capital.

During the 2008 financial crisis for example, many banking agents made predatory loans incentivized by commission disregarding the long term damage it would have on the bank. (many of which needed to be bailed out)

The borrowers themselves also put too much faith in housing prices and ended up committing to loans to which they didn't fully understand and lifestyles that relied on rising prices. Many lost their homes as their prices went underwater.

Why this Matters

Most of what people consider money is actually credit. In 2013, Ray Dalio estimates that there is $50 trillion dollars of credit to $3 trillion dollars of hard money.

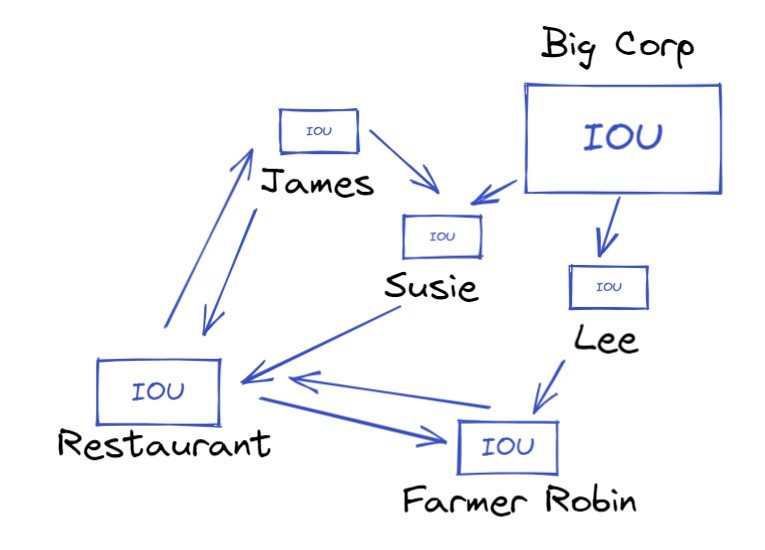

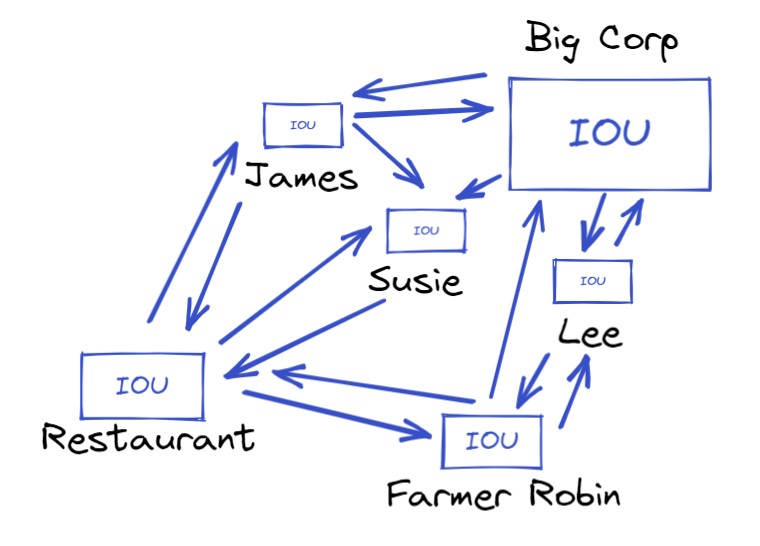

All this credit runs the economy. It is in everyone's paychecks and those paychecks trickle down into the local restaurants, farmer's markets, baby sitters, landscapers, barber shops, and movie theaters.

All this credit is kept into existence by the promise of future payments. Almost all of our present day activity is kept running by our ability to predict and control the future and make good on our promises.

This is why events like natural disasters, wars, or pandemics like COVID cause so much damage. They are emergency situations that force many to back out of their promises. This causes massive sudden evaporation of credit and can cause entire ecosystems to starve.

It also matters for stocks because the same mechanism that injects money from the future into the present is also used by large corporations when they take out debt. When the future feels easy to predict, the cost of capital is cheap and companies can use this money to aggressively expand. Venture capitalists similarly feel empowered to invest in bigger moonshots and radically innovative startups.

However in a volatile environment the ability to extract future money into the present is impaired and these types of companies take a valuation hit since they rely on a strong and far reaching narrative.