Profiting from Efficient Market Hypothesis

The Efficient Market Hypothesis (EMH) is an investment theory that states that financial markets reflect all available information. This suggests that it is not possible to consistently achieve returns above the market average by using publicly available information.

It implies that reading information about GDP, inflation, company earnings, political events, new regulation and technological advancements provides no advantage as the information is quickly and efficiently integrated into the price.

There are two dominant attitudes towards this theory:

The first is a strong belief . These individuals do not try to beat the market and instead try to keep up with it.

They dollar cost average into SP500 index funds and are a fan of automatic strategies that give a sense of progression towards a FIRE FIRE retirement.

The other group skeptically rejects the theory because “humans are not rational”. This group includes active day traders, speculators, YOLO r/wallstreetbets , and even value investors like Warren Buffet .

However I’d like to propose a theory of efficient market hypothesis that states that markets ARE efficient and that this very efficiency is what allows savvy individuals to outmaneuver the market.

What is "Efficiency"?

To start, a good definition of efficiency:

Efficiency basically means that there is no additional benefit to increasing or decreasing the price.

Imagine you are a shopkeeper. If you want to increase your profit you can increase the price. However this decreases demand so you sell less.

Vice versa you might try and decrease your price to encourage more buyers and try to make more profit through volume.

In both cases, total profit can end up the same or even lower.

Markets all over work the same. Whether it’s buying and selling groceries, antique trinkets, or stocks and bonds, items tend towards the price where there is no benefit to increase or decrease.

The Hidden Element: Time

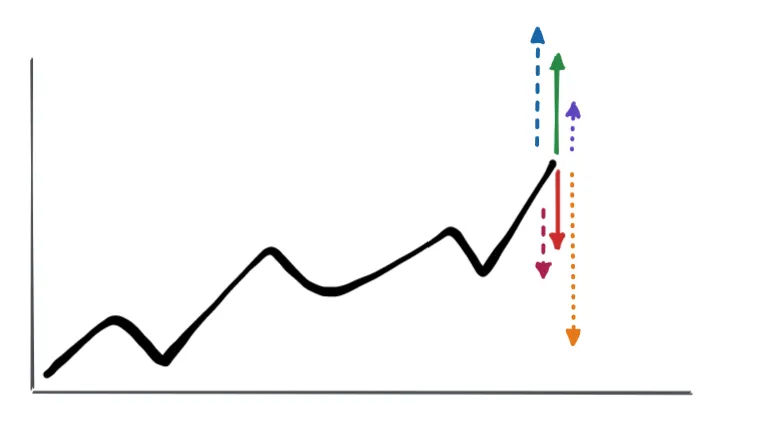

Prices however as we know, go up and down. Often times very quickly and suddenly.

How is it possible to reconcile the idea of market efficiency with prices that crater by 80% or double and triple within a day?

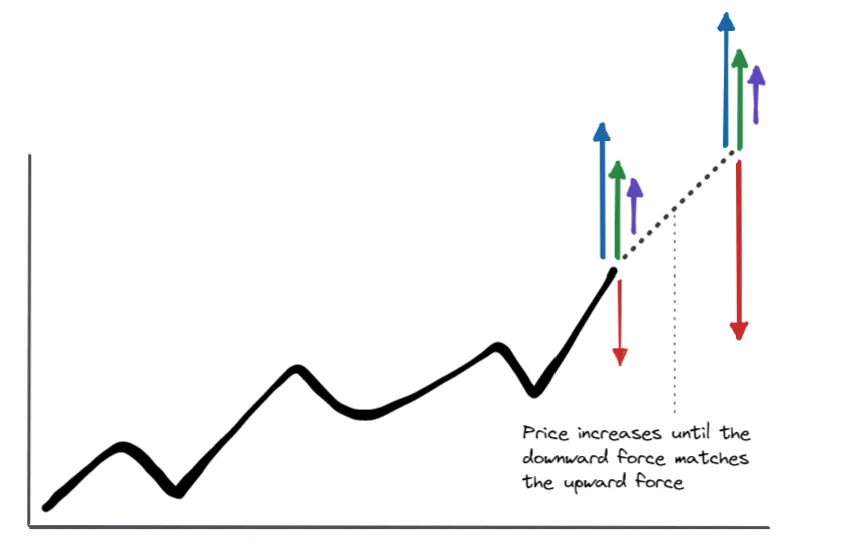

The trick is to realize that markets are efficient only at each specific moment in time.

Each successful transaction occurs at a point where the upward forces that increase price are perfectly balanced by the downward forces that decrease price.

As an example, say you wanted to buy a ticket from a scalper last second for a concert. There are forces that increase price like really wanting to go and the scarcity of the ticket balanced out by forces that decrease price like the chance of getting scammed and being indignant at price gouging.

Once the concert is over, the price can crater. The ticket becomes a memento which is an entirely different market.

However, each transaction still occurs at a point where the upward and downward forces roughly balance out.

Whenever you buy something you are implicitly stating “I want to have this NOW.”

If you were dying of thirst in a desert, a bottle of water would be worth a lot more than if you were at home.

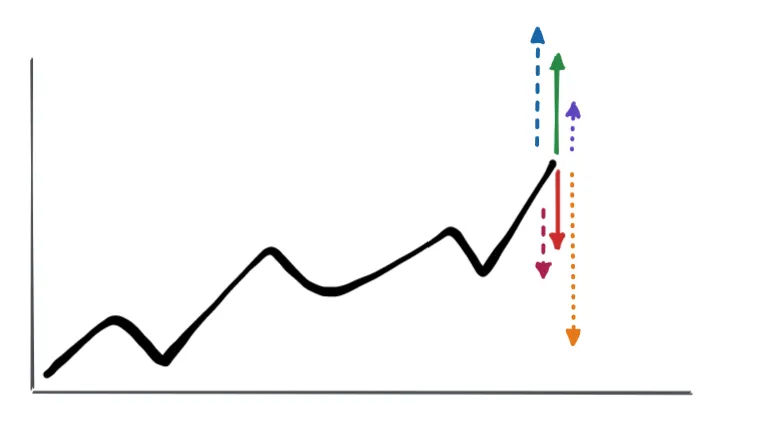

Every market including equity markets are composed of individuals with different time horizons. Some need the stock NOW because they need to cover a short position or don’t want to FOMO on the next big rally. Others may only buy when there is "blood in the streets".

These different buyers contribute different types of upward and downward forces on a stock’s price.

Short Term vs Long Term Forces

Markets are so efficient that they integrate all of this information.

However these forces, although strong, are often short term.

At each moment in time, the price is held in a precarious balance by a combination of short term and long term forces that cancel out to create the real-time market price.

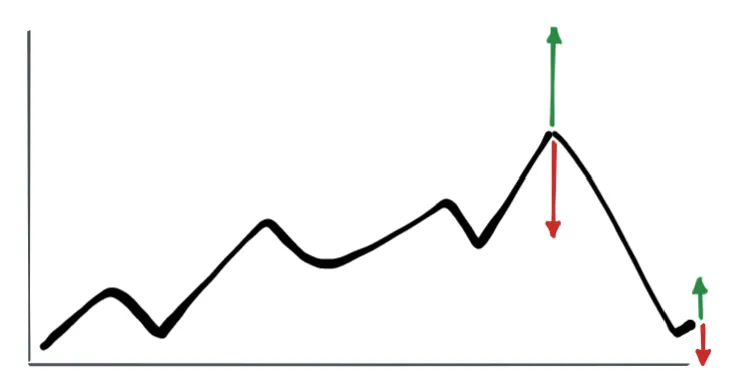

When a downward force suddenly evaporates (e.g. uncertainty that is suddenly cleared up with a regulation announcement) then the efficient market quickly and rapidly increases the price until the downward and upward forces match.

The price can similarly free fall if an upward force suddenly dissipates.

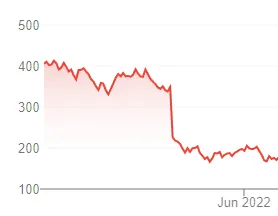

Meme stocks and things like crypto have a lot more crowd momentum and emotionally driven decisions. The short term forces are very strong and come and go very quickly.

FOMO for example can create a rapid but temporary upward price appreciation. This happens a lot in crypto as individuals scramble for DOGE coin because they need it NOW.

This is compounded by traders who seeks to make a profit on this momentum. Like ticket scalpers, they buy and sell not because they care about the underlying but because there’s a profit margin.

This means that rapid price changes are actually a feature of efficient markets!

The market rapidly and efficiently updates itself to the comings and goings of a volatile crowd often powered by greed and fear.

Rational Considerations

This theory of Efficient Market Hypothesis states that markets are so efficient that they capture the irrationality of emotionally charged and sometimes overleveraged decisions.

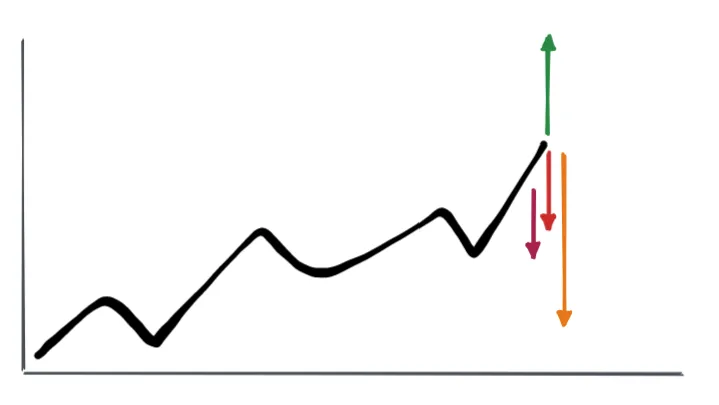

A rational and savvy actor who has a longer time horizon who doesn’t “need to have it NOW!” can carefully consider the price and analyze how much of the upward and downward force is ephemeral and how much is driven by long term considerations.

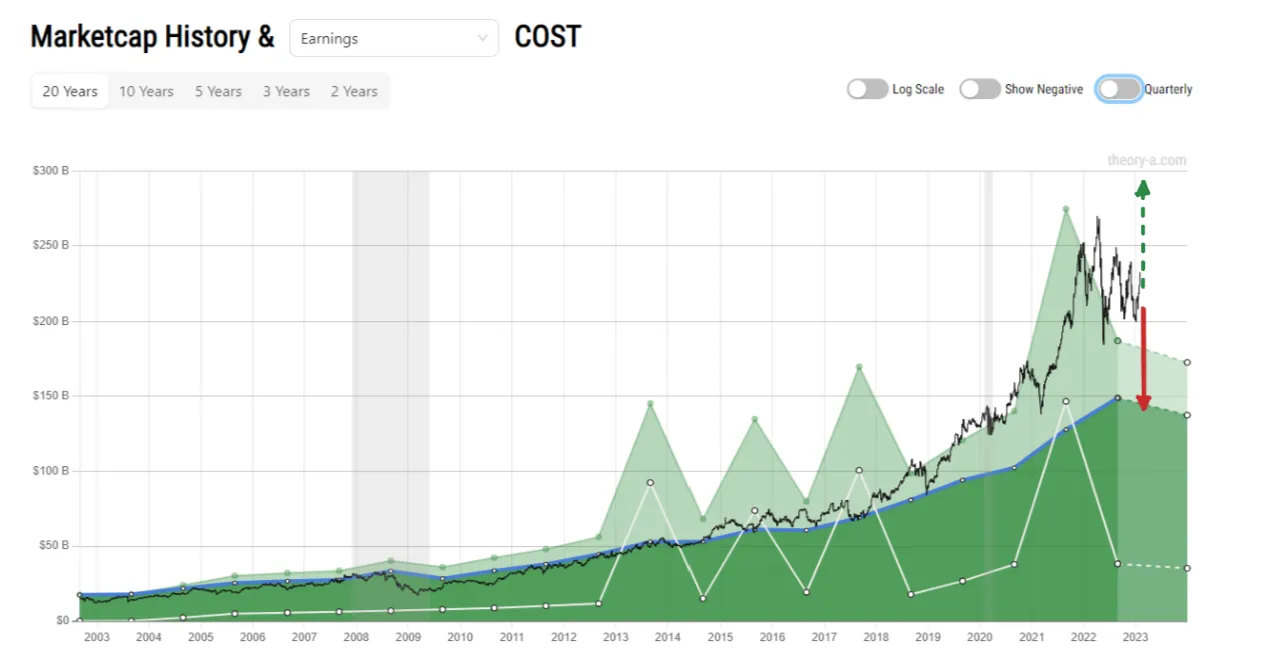

As an example, Costco is a great company and feels like a safe buy, but this sentiment is so common that the market has already captured a lot of this in the price.

The upward force is mostly emotional while the downward force is based on fundamentals. The downward force is longer term and based on real things like cash flow and economic conditions while the upward force is fueled by sentiment.

This doesn’t mean it’s a good idea to short the stock or buy puts. Such positions require a lot of skill and also some luck with timing. However it can encourage individuals decide to allocate their capital elsewhere to something that is less over-subscribed.