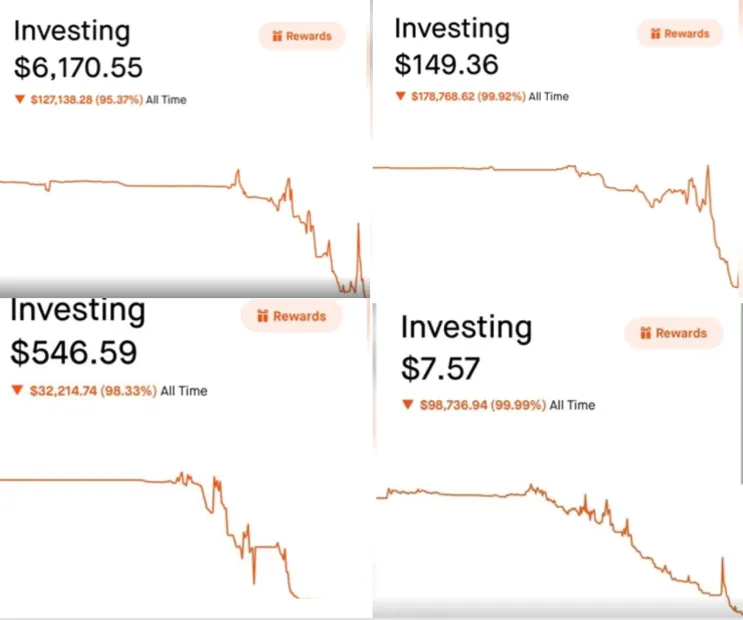

Why Does Loss Porn All Look the Same?

Notice what's special about all the loss porn of r/wallstreetbets?

Ever notice that the lines all seem pretty similar?

The investor discover options, gets a small early win, goes on a wild roller coast up and down, but overall trends downwards and eventually loses over 90% of the portfolio.

This post will explain why this happens, why it’s almost guaranteed to happen, and how to protect against this.

Ergodicity

These lines are a result of a concept called “ergodicity”, a complex mathematical term popularized by Nassim Taleb. Taylor Pearson has a in-depth explanation, but here is an overly simplified version:

-

An ergodic process makes sense for a group and for individuals.

-

A non-ergodic process makes sense only for a group but not an individual.

An example is something dangerous like riding a motorcycle without a helmet or shark wrestling. Let’s say the death rate is 1%.

If 100 people do this, the expected death count is 1 person.

However if 1 person does this 100 times… the death rate is unintuitively 63%.

This is because the chance of surviving once is 99% or 0.99

The chance of surviving twice is 0.99 * 0.99 or 0.98

The chance of surviving three times is 0.99 ^ 3 or 0.97 and so on.

The survival rate gets closer and closer to zero the more you repeat the process.

Surviving 100 times is 0.99 ^ 100 (0.366) or around a 37% chance of living and a 63% chance of dying)

The intuition behind this: if you do something dangerous long enough, eventually it will kill you.

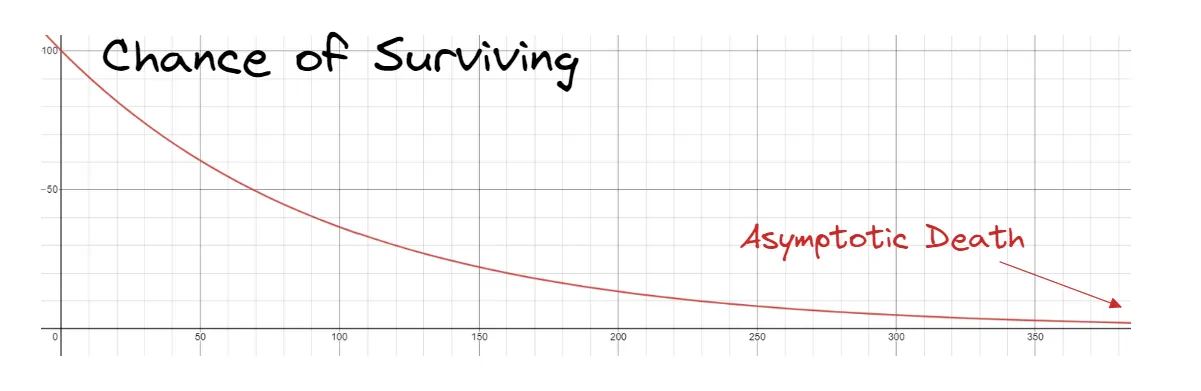

Asymptotic Death

A lot of retail options trading has a similar risk profile. Each action itself seems harmless, but over a long enough period of time the chance of “death” inches closer and closer to 100% even if it never quite reaches it. It asymptotically approaches it.

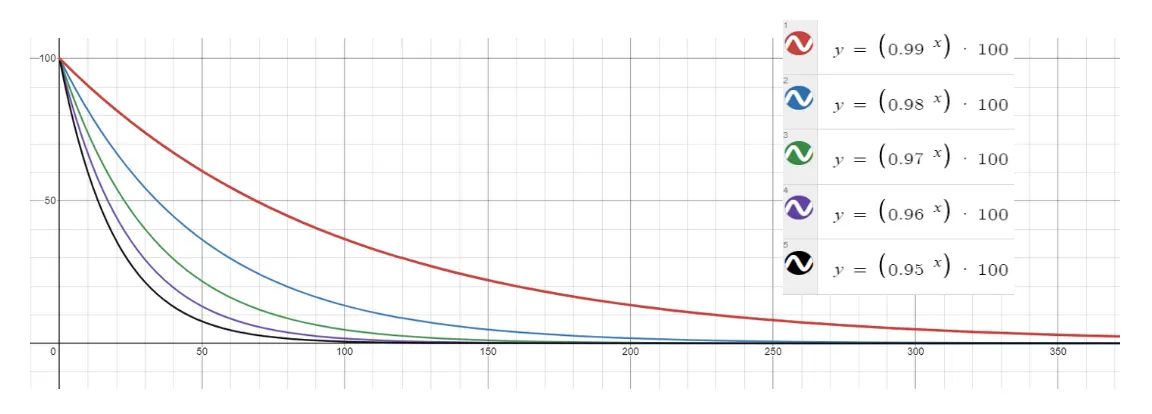

Even small changes to the chance of success can drastically change the survival rate. In the below chart the red line shows how a 99% rate of survival fares over time while the blue, green, and purple lines show 98%, 97%, 96% and so on.

With a 95% survival rate, the chance of surviving just 13 times is a dismal 50%. Notice how sharply the odds decrease relative to the red line.

Given how big wallstreetbets is, there are always individuals who survive by pure chance alone. Their success plastered over the front page gives others the impression that there is some sort of secret that can be applied.

However, what makes sense for the group does not always make sense for the individual. Just because Squid Game has a winner doesn’t mean that it makes sense to play it.

How to Avoid This?

The key to avoiding asymptotic death is to invest as if you were playing an incredibly difficult game of infinite poker. With every single hand you have only limited and noisy information. Each bet has to be sized accordingly with the humility to know that you are never guaranteed to win.

Many players do the equivalent of going all-in round after round after round because everyone else around them is doing it or they were double-dared to. They want to go to showdown every round and don’t realize how much folding is involved where there are real table stakes.

To learn more about proper bet sizing, learn about the Kelly Criterion via the Theory A Kelly Game Simulator.